The ground beneath the PC market is shifting, and the tremors are now undeniable. What was once a niche concern for server farms has erupted into a full-blown crisis for gamers and builders alike: the AI boom is directly responsible for a dramatic surge in the cost of essential components like RAM and SSDs. We are not just witnessing a price hike; we are in the midst of a ‘RAMageddon,’ a market upheaval driven by an insatiable demand for artificial intelligence infrastructure that is fundamentally reshaping how we acquire and value PC hardware. This isn’t merely an inconvenience; it’s an urgent call to action for anyone planning a build or upgrade, as the data points to a sustained period of scarcity and escalating prices.

Key Takeaways

- AI’s Insatiable Hunger: High-Bandwidth Memory (HBM) demand for AI data centers is diverting production from consumer RAM (DRAM) and NAND, leading to a global shortage.

- Escalating Prices: IDC and industry leaders predict significant PC memory price increases (30-60% for DDR4, higher for DDR5) through 2026 and potentially 2027.

- The Pre-Built Loophole: Some consumers are finding better value in pre-built PCs, as manufacturers can often secure memory at lower prices than individual DIY builders.

- Act Now, If You Need To: Expert advice suggests purchasing necessary memory/storage sooner rather than later to mitigate future price hikes.

- Manufacturer Responses: Major players like Micron are investing billions in new fabs, but production ramps will take years, meaning immediate relief is unlikely.

The AI Super Cycle: Why Your RAM Prices Are Soaring

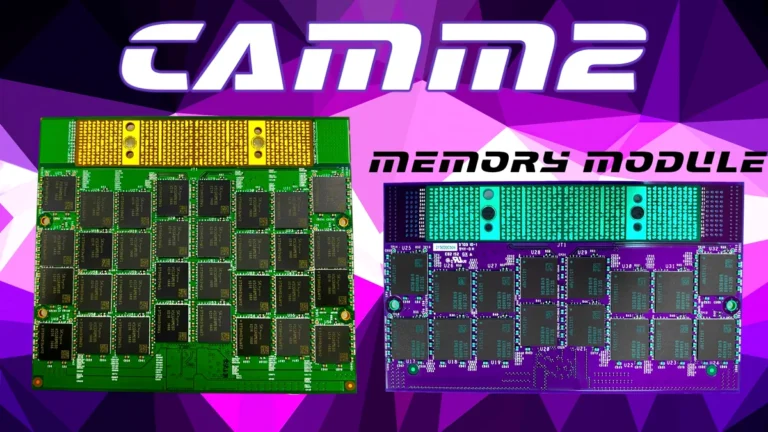

At the heart of this memory crisis is the unprecedented, almost insatiable demand for High-Bandwidth Memory (HBM) from the burgeoning AI sector. AI data centers, which require immense computational power to train and run complex models, are voraciously consuming HBM due to its specialized design for extremely high performance. Major memory manufacturers—Samsung, SK Hynix, and Micron—are prioritizing HBM production, actively reallocating wafer capacity away from standard consumer-grade DRAM (Dynamic Random-Access Memory) and NAND flash memory (used in SSDs). This strategic pivot, driven by the significantly higher profit margins of HBM, leaves the mainstream market with drastically reduced supply. The shift is so profound that it’s been dubbed an ‘AI Super Cycle,’ unlike any previous market trend, fundamentally altering the memory supply chain.

- HBM Prioritization: Major fabs are actively reallocating production capacity to high-margin HBM, squeezing standard DRAM supply.

- DDR4’s Phased Exit: Memory vendors are preparing to move on from DDR4, creating supply instability for systems still reliant on it.

- Margin-First Strategy: Companies are prioritizing high-profit AI chips, leading to higher memory margins than even foundry businesses.

- Unprecedented Scale: Unlike previous cycles (smartphones, crypto), AI demand is larger, more persistent, and involves global corporate investment.

“Most of the memory from the top players ‘is going directly to AI infrastructure, but many other products need memory, so those other markets are starved today because there is no capacity left for them.'”

— Sassine Ghazi, CEO of Synopsys

The Domino Effect: How Server Demand Hits Your Gaming PC

The ripple effects of this HBM prioritization are now directly impacting the availability and pricing of consumer-grade DDR5 RAM and SSDs. As manufacturing capacity is diverted to serve the booming AI sector, the mainstream market experiences longer lead times, with some extending from 8-10 weeks to over 20. Spot market availability for these crucial components has become alarmingly thin, and even long-term buyers are encountering allocation restrictions, meaning they cannot purchase beyond their contracted volumes. This scarcity has unfortunately opened the door to increased risks, with reports emerging of counterfeit memory, particularly DDR4 mislabeled as DDR5, circulating in consumer marketplaces. For PC enthusiasts, this means not only higher prices but also heightened vigilance against fraudulent products.

Memory Market Cycles: AI Super Cycle vs. Past Trends

| Factor | Past Cycles (e.g., Mobile, Crypto) | Current AI Super Cycle |

|---|---|---|

| Primary Driver | Smartphone growth, cryptocurrency mining | Generative AI, hyperscale inference workloads |

| Demand Scale | Significant but often cyclical | Unprecedented, persistent, and evolving daily |

| Market Consolidation | Moderate, multiple players | High, dominated by a few major firms (Samsung, Micron, SK Hynix) |

| Capacity Shift Incentive | Profit gains in specific segments | Massive, sustained high-margin opportunities with public touting of record profits |

| Impact on Consumer | Price volatility, temporary shortages | Severe price hikes, allocation restrictions, increased counterfeit risks, multi-year crunch |

The Price Shock: What to Expect and When

The financial implications of this market realignment are already hitting hard. Industry analysts, including IDC, are forecasting significant PC price increases by 2026, directly attributing them to the memory crunch. Sassine Ghazi, CEO of Synopsys, a key semiconductor design tool company, has explicitly stated that memory shortages are likely to persist through 2026 and even into 2027. We’re talking about substantial projected price surges: DRAM saw increases of up to 60% in 2025 alone, with another 30-40% rise expected in 2026, particularly for DDR4 and high-density DDR5. HBM pricing, which is driving this entire phenomenon, has already reached record highs and continues its upward trajectory. These aren’t just predictions for the distant future; as Ghazi notes, these price hikes are, in his words, “happening already.”

Projected Memory Price Increases (2025-2027)

Data based on industry forecasts and reported surges. Note: 2027 figures are projections, assuming current trends continue and new fab capacity slowly comes online. These represent cumulative increases over previous years.

Should You Buy Memory Now or Wait?

Pros of Buying Now

- Beat Anticipated Hikes: Prices are forecasted to rise significantly through 2026 and possibly 2027.

- Avoid Allocation Issues: Securing components now reduces risk of future scarcity or restricted purchases.

- Lock in Current Value: Prevents regret over missed lower prices, a common sentiment in the community pulse.

Cons of Buying Now

- Potential for ‘AI Bubble’ Burst: Some speculate prices might stabilize or drop if AI demand cools (though unlikely in the short-term).

- Newer Tech Around the Corner: Waiting could mean access to even faster or more efficient memory generations, but at potentially higher prices.

- Initial Higher Cost: DDR5 modules are still more expensive than DDR4, and current prices are already elevated.

The Gamer’s Dilemma: DIY vs. Pre-Built in the Age of Scarcity

For PC enthusiasts, the ‘RAMageddon’ presents a unique strategic challenge. A sentiment gaining traction within the gaming community is that pre-built systems have become a pragmatic ‘loophole’ to acquire memory components more affordably than purchasing them separately. Major PC vendors, such as Dell and Lenovo, often possess better leverage in securing memory supply due to their immense purchasing power and diversified global supply chains. This allows them to integrate RAM and SSDs into their systems at prices individual DIY builders simply cannot match on the open market. The impact on the DIY market is palpable, pushing builders towards what was once considered a less ideal option. As an extreme symptom of this scarcity, we’ve even seen the emergence of gaming PCs being sold ‘without RAM’ entirely, forcing consumers to source their own—a stark indicator of the market’s current disarray.

Pro-Tip for PC Builders

If you’re struggling to source affordable RAM or SSDs, thoroughly research pre-built systems. Some manufacturers are offering surprisingly competitive prices on complete machines, making them a viable, albeit unconventional, source for components during this ‘RAMageddon’. Always compare the total cost and component quality carefully.

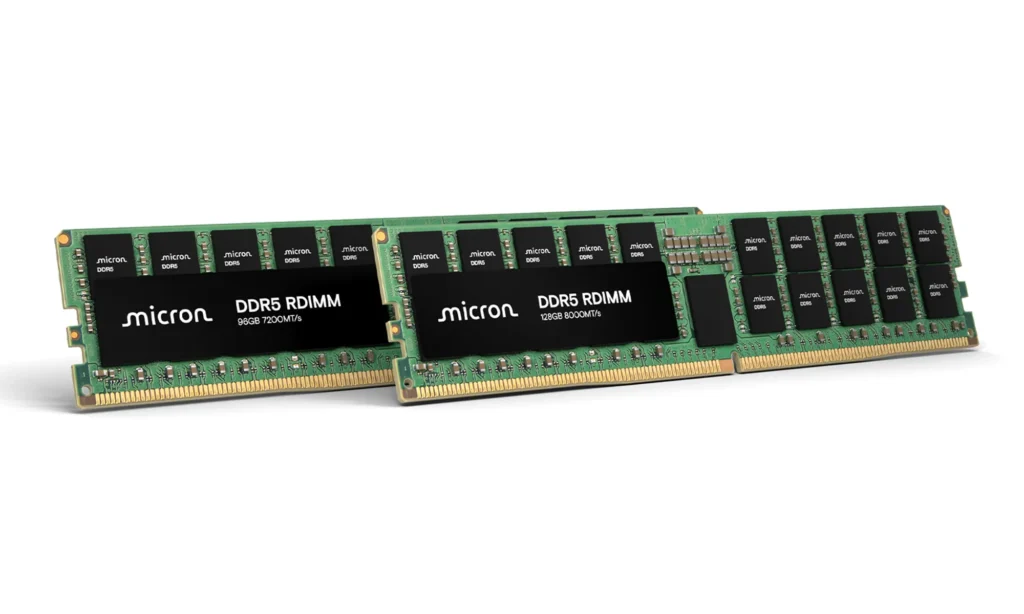

Looking Ahead: Manufacturer Strategies and Future Supply

In response to this unprecedented demand and the resulting market strain, major manufacturers are making colossal investments. Micron, for instance, has committed approximately $24 billion over ten years to an advanced wafer fabrication facility in Singapore, with wafer output scheduled to begin in the second half of 2028. They’ve also broken ground on a $100 billion memory manufacturing complex in New York, with production commencing around 2030, and acquired a fabrication site in Taiwan for $1.8 billion, expecting meaningful DRAM output by the second half of 2027. These are significant, long-term commitments, but their multi-year lead times mean immediate relief from the current crunch is highly improbable. Simultaneously, some industry players are exploring alternative strategies. HP is reportedly eyeing Chinese suppliers like CXMT and YMTC for DRAM, signaling a potential diversification away from the ‘big three.’ Chinese manufacturers are rapidly expanding, with CXMT launching DDR5-8000 chips and planning a massive IPO, indicating a growing domestic capacity that could eventually reshape the global supply chain, though questions about scale and quality remain.

- Micron’s Global Expansion: Billions invested in new fabs in Singapore, New York, and Taiwan, with production ramps expected from 2027 to 2030.

- HP Diversification: Exploring Chinese suppliers like CXMT and YMTC for DRAM, signaling a potential shift in the global supply chain.

- Chinese Market Growth: CXMT’s launch of DDR5-8000 and LPDDR5X-10667, and IPO plans, indicate a growing domestic capacity.

- Long-Term Horizon: Even with new fabs, the time to bring them online means the current crunch is unlikely to see immediate relief from increased production.

Your Burning Questions About the Memory Crisis, Answered

Is DDR5 better than DDR4 for gaming, and how does this shortage affect it?

How long is this memory shortage expected to last?

Should I buy a pre-built PC instead of building my own right now?

Are memory manufacturers intentionally limiting supply to drive up prices?

What’s the difference between DRAM, NAND, and HBM?

Navigating the ‘RAMageddon’: A Gamer’s Imperative

The ‘RAMageddon’ isn’t just a catchy phrase; it’s the defining challenge for PC gamers and builders in the mid-2020s. The insatiable demand for High-Bandwidth Memory (HBM) from the burgeoning AI sector has created a seismic shift in the global memory market, directly impacting the availability and affordability of your next gaming rig’s essential components. With forecasts predicting continued price surges through 2027 and major manufacturers shifting focus, the days of abundant, cheap RAM are on hiatus. For those planning a new build or upgrade, proactive purchasing of memory and storage components is the most pragmatic strategy. While the long-term outlook includes massive investments in new fabrication facilities, immediate relief is unlikely. Adaptability, careful budgeting, and a keen eye on market trends will be your greatest allies in surviving this unprecedented era of PC hardware inflation.